DOWNLOAD THIS REPORT HERE (PDF)

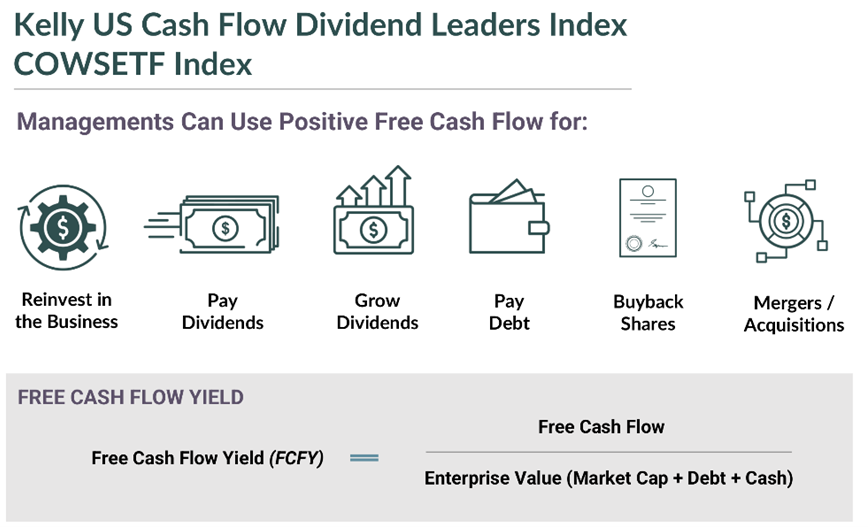

Free Cash Flow (“FCF”) Yield is one of the most important fundamental metrics indicating a firm’s financial health. FCF Yield measures the amount of cash generated from the core operations of a company relative to its valuation.

The Kelly US Cash Flow Dividend Leaders Index (symbol: COWSETF Index) targets US companies with consistent dividend growth by screening for high free cash flow yields.

The COWSETF Index distinguishes itself by utilizing a Forward FCF Yield and Trailing FCF Yield ranking system (rulebook).

High quality FCFY indexes need to incorporate both FCF Yields as they are inextricably linked.

The COWSETF Index system of incorporating forward FCF Yield can be a better measure of value and quality than other valuation metrics, including other high FCF Yield indexes. COWSETF Index provides a more comprehensive and accurate snapshot of a company’s potential profitability because of the forward look of a company’s cash flow. Meanwhile, the trailing high FCF Yield reflects actual cash generated by a business and is less subject to accounting manipulation.

By coupling both trailing and forward, COWSETF Index’s methodology demonstrates critical components on how to invest in free cash flow yield and dividends.

How to Invest

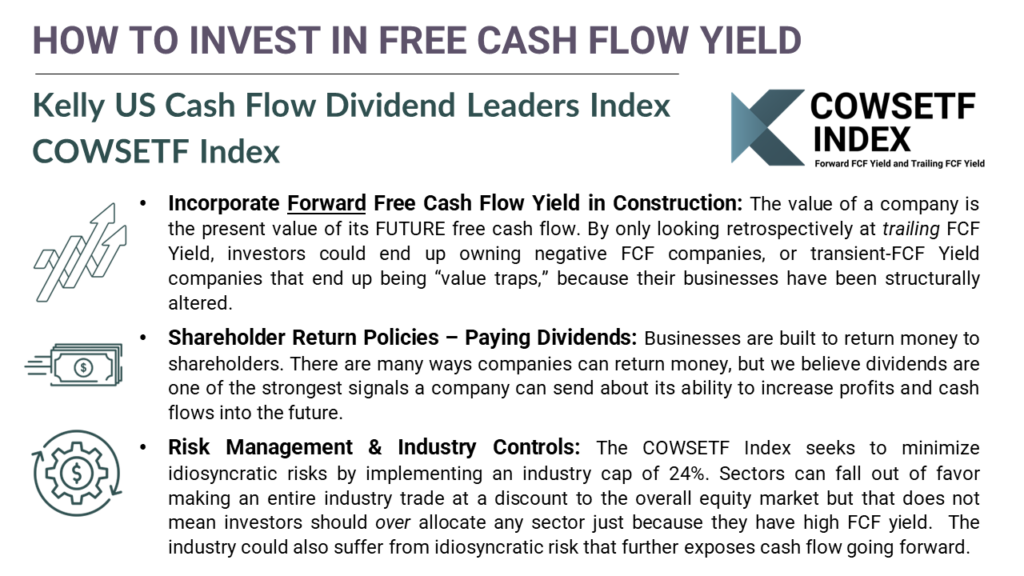

The three important aspects that should be adhered to before investing in a free cash flow strategy:

- Incorporate Forward Free Cash Flow Yield in Construction: The value of a company is the present value of its FUTURE free cash flow. By only looking retrospectively, or only evaluating trailing FCF, investors could end up owning negative FCF companies, or transient-FCF Yield companies that end up being “value traps,” because their businesses have been structurally altered.Trailing only FCFY indexes can be exposed to companies that are anticipated to have negative FCF or won’t have free cash flow going forward. The Pacer US Cash Cows 100 Index (COWZ Index) is currently holding two constituents that are anticipated to have negative FCF for 2023 according to Bloomberg’s Financial Statement Analysis. One of those COWZ Index constituents anticipated to have a negative cash flow in 2023 is Hawaiian Electric. Hawaiian Electric is the utility company ensnared in the fallout of the devastating Maui wildfires that killed around one hundred (100) people. On August 24, 2023, Hawaiian Electric said it has suspended its dividend and significantly drew down lending facilities as it faces a new lawsuit. Three weeks later, on September 15, 2023, The COWZ Index added Hawaiian Electric to its “high quality cash cows” portfolio.

- Shareholder Return Policies – Paying Dividends: Businesses are built to return money to shareholders. There are many ways companies can return money, but we believe dividends are one of the strongest signals a company can send about its ability to increase profits and cash flows into the future. For investing in shareholder friendly companies, estimating future cash flow is important because the forecast shows how much cash a company is likely to have available in the coming period. Important insights can be derived from management’s conviction in distributing cash back to its owners.

- Risk Management & Industry Controls: The COWSETF Index seeks to minimize idiosyncratic risks by implementing an industry cap of 24%. Investing takes discipline and there should be a focus on risk exposure and diversification, especially to avoid idiosyncratic sector risks. Sectors can fall out of favor making an entire industry trade at a discount to the overall equity market, but that does not mean investors should over allocate any sector just because they have high FCF yield. Getting in and out of the right sectors, at the right times, is difficult for several reasons, including the nature of rebalancing and the lag effect. Another key aspect of risk management is to avoid being mandated to hold a specific number of constituents. Any quality or value strategy should not be forced to own a set number of positions, for example, one hundred (100), as the degree of quality can become comprised as well as being forced to own positions like Hawaiian Electric.

How to Implement

Exposure to the COWSETF Index can be a differentiator within the core of an equity portfolio by capturing U.S.-domiciled companies with the highest – trailing and forward – free cash flow yields.

Tool for Diversification: COWSETF Index can be a complement to traditional equity core strategies.

- Offers a tool for diversification due to little overlap with traditional indices.

- Differentiated sector allocation versus Russell 1000 and S&P 500 Index.

- Lower valuations than Russell 1000 and S&P 500 Index.

Disclaimers:

This document is for informational purposes only and is not intended to be, nor should it be construed or used as an offer to sell, or a solicitation of any offer to buy, any security. Additionally, the information herein is not intended to provide, and should not be relied upon for, legal advice or investment recommendations. You should make an independent investigation of the matters described herein, including consulting your own advisors on the matters discussed herein. In addition, certain information contained in this document has been obtained from published and non-published sources prepared by other parties, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for the purpose used in this document, such information has not been independently verified by Kelly Indexes LLC (“Kelly”) and Kelly does not assume any responsibility for the accuracy or completeness of such information. Kelly Indexes LLC, its affiliates and their independent providers are not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Charts, graphs, and graphics are provided for illustrative purposes only. It is not possible to invest directly in an index. Exposure to an asset class represented by an index is available through investable instruments based on that index. All trademarks or registered trademarks are owned by their respective parties and Kelly makes no claims on them or their use.

[NAME] SITE

Thank you for visiting Kelly Intelligence

You are now being redirected to our [NAME] site.